Quarterly Payroll Tax Due Dates 2023

Payroll tax dates due upcoming important three compiled mindful owners want business list. Tax dates due self employed estimated avoid bill huge re when expenses organize business. Payroll tax penalties small businesses should know about workest. 941 form quarterly information payroll report sample reports register detail employee tax medicare. Reducing estimated tax penalties with ira distributions. Tax july expect 15th season reach questions please any payment. Here are key tax due dates if you are selfemployed – forbes advisor. Tax season what to expect now that tax day is july 15th thomas doll. Tax due dates employed self forbes calendar advisor taxes 2021 getty. Payroll penalties workest each

Quarterly payroll tax due dates 2023. Our site had contents like Here are key tax due dates if you are selfemployed – forbes advisor, payroll tax penalties small businesses should know about workest, reducing estimated tax penalties with ira distributions in photos, backgrounds, and more. On this page, Our site also have a variety of portraits available. Such as png files, JPG files, animated graphics, art, logos, monochrome, see-through, and more.

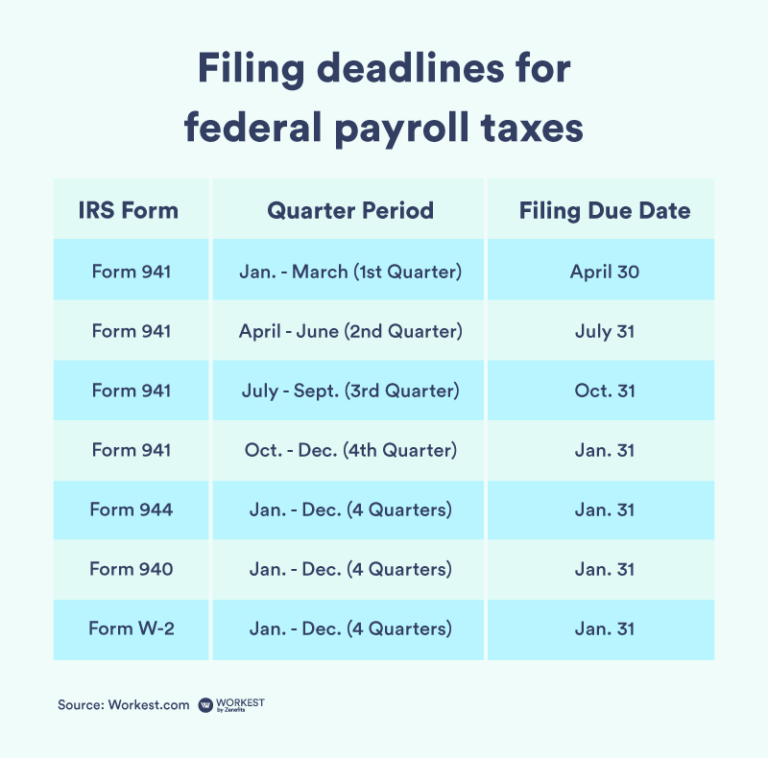

Payroll Tax Penalties Small Businesses Should Know About Workest. Payroll penalties workest each

How To Avoid A Huge Tax Bill When You're SelfEmployed Careful Cents. Tax dates due self employed estimated avoid bill huge re when expenses organize business

Federal Payroll Calculator 2023 EllisLujane.

Here Are Key Tax Due Dates If You Are Selfemployed – Forbes Advisor. Tax due dates employed self forbes calendar advisor taxes 2021 getty

How To Pay Payroll Taxes Everything You Should Know In 2020 Hourly, Inc.. Payroll pay irs

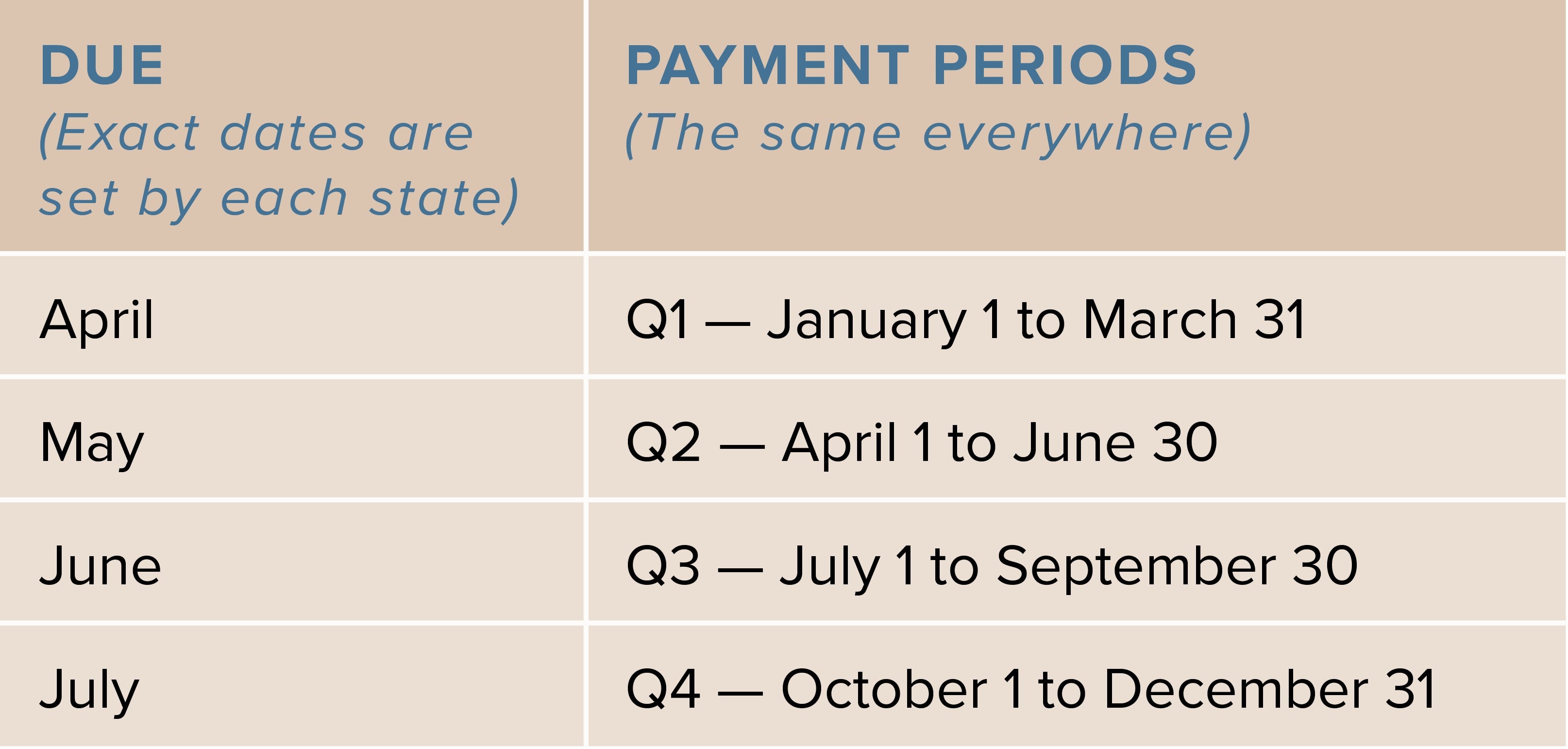

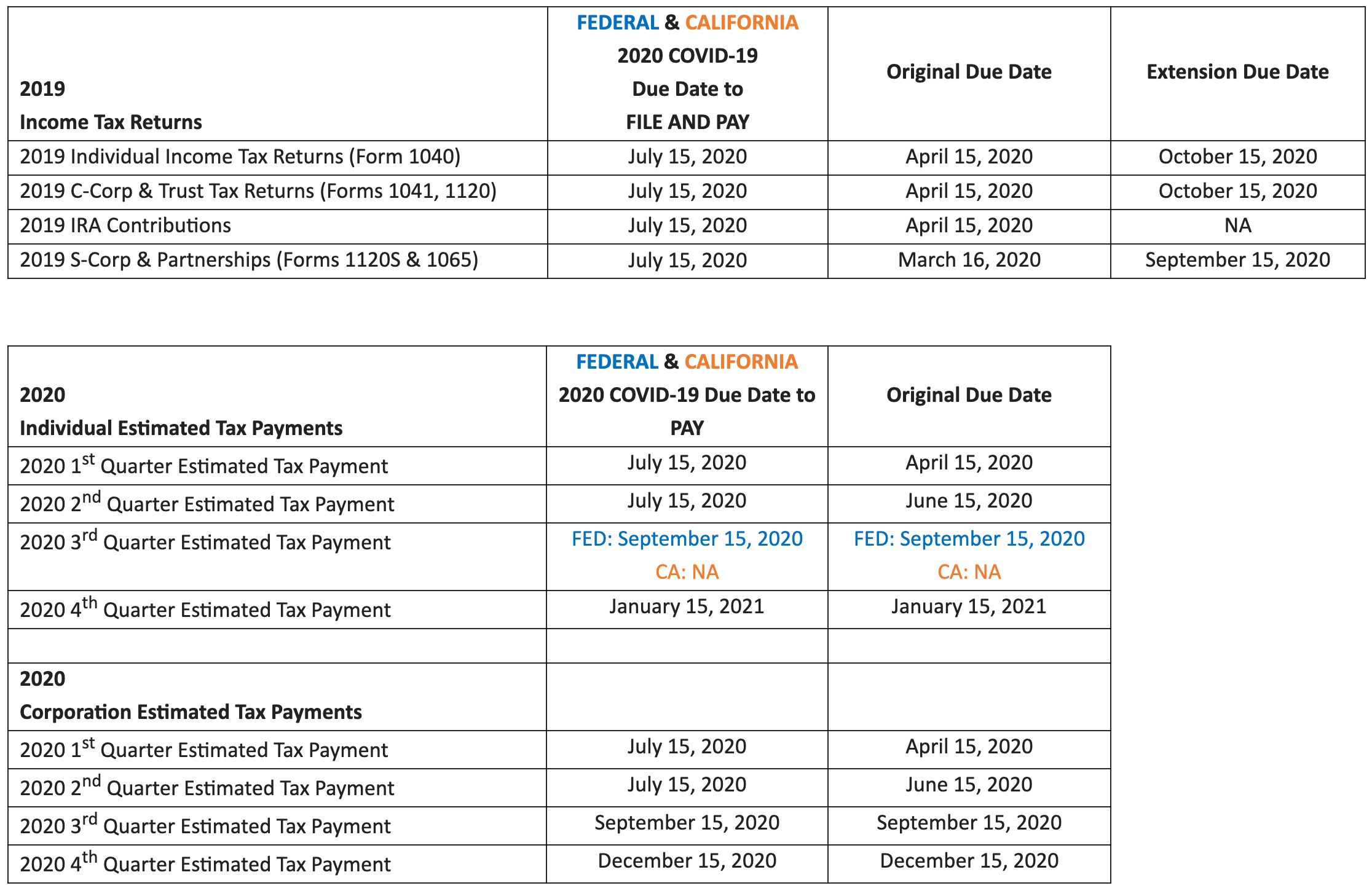

2019 Quarterly Estimated Tax Due Dates. Due quarterly dates tax

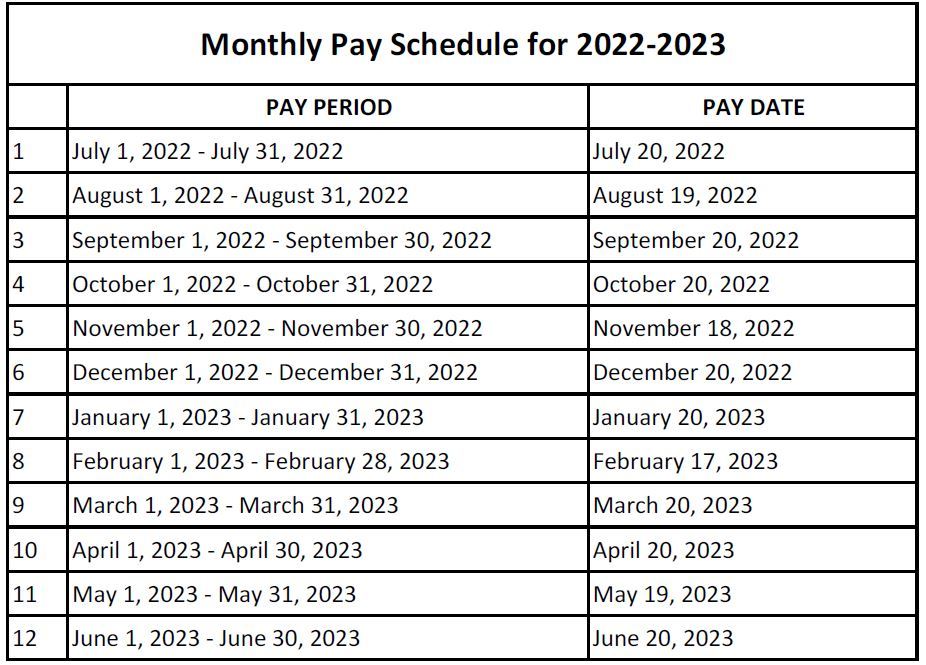

Monthly Pay Schedule.

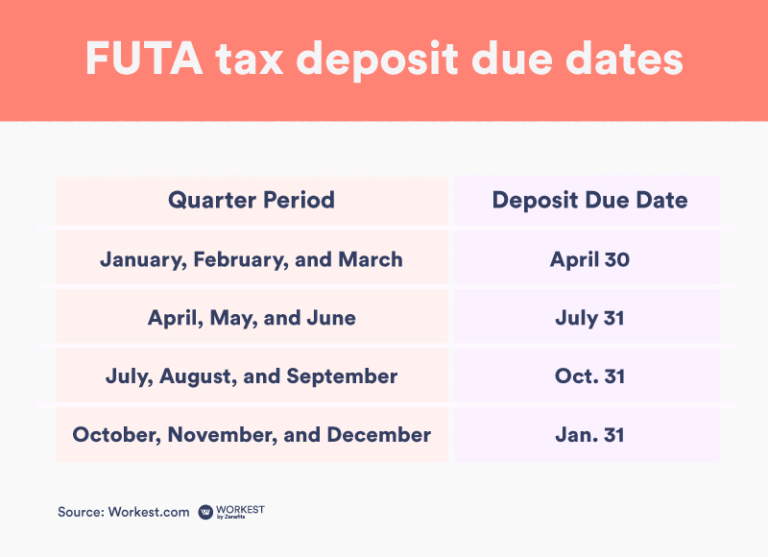

Payroll Tax Penalties Small Businesses Should Know About Workest. Tax payroll penalties workest futa deposit

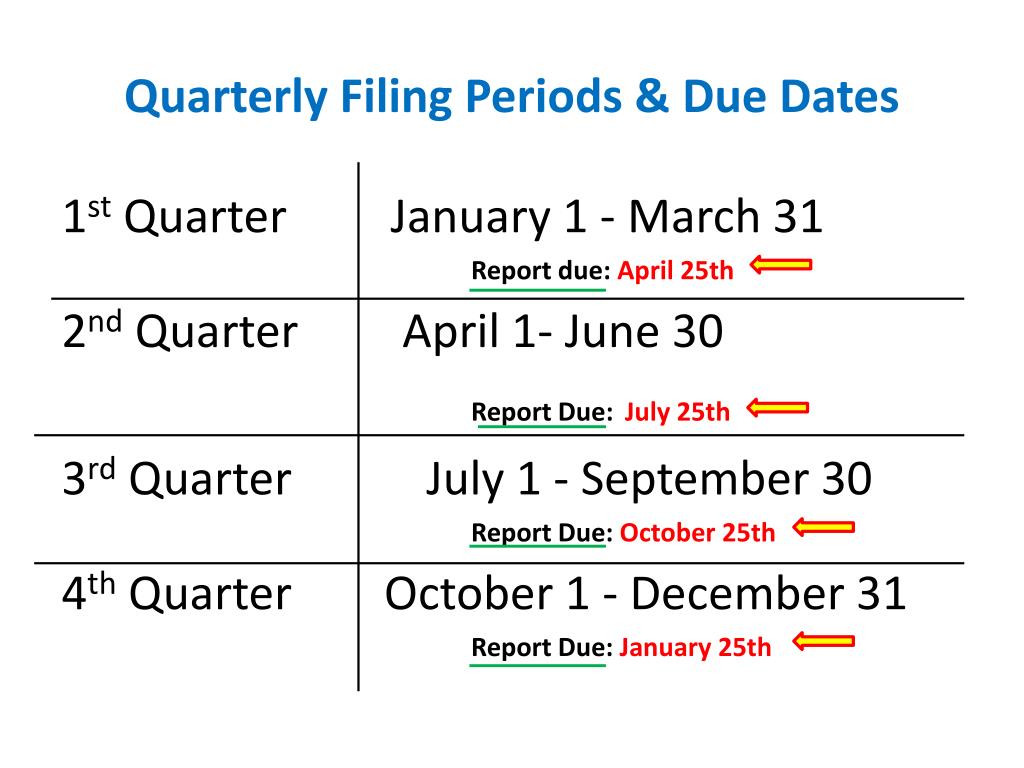

What Are Quarterly Wage Reports And Why Do They Matter? SmallBizClub. Quarterly wage reports tax due reporting matter payment smallbizclub periods date accounting why they include mind keep things other

Reducing Estimated Tax Penalties With IRA Distributions. Tax penalties distributions indicated following withholding deadlines

Tax Due Dates Shirley MA. Tax quarterly dates due schedule billing shirley ma

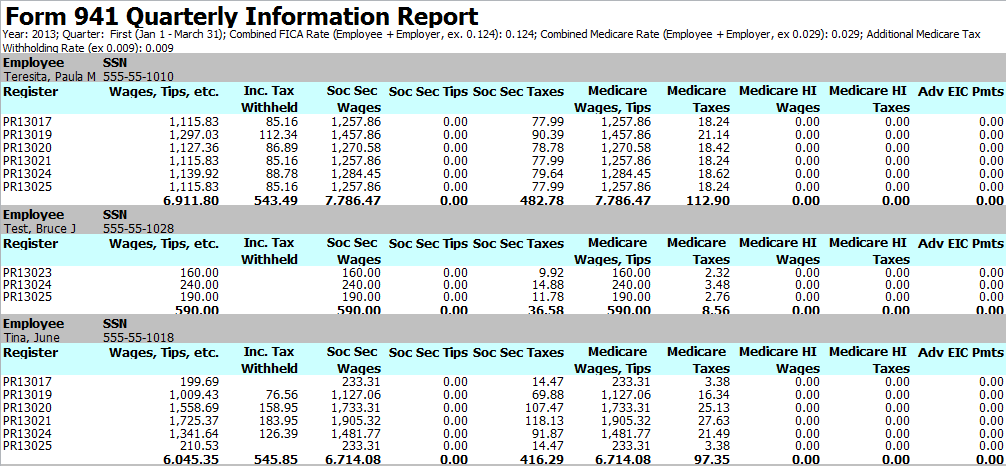

PY Form 941 Quarterly Information Report. 941 form quarterly information payroll report sample reports register detail employee tax medicare

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor. Quarterly payments estimated

List Of All The Important Due Dates With Respect To #TDS & Income Tax. Payroll tds hostbooks liabilities filing

New Federal Tax Due Date Changes Here’s What You Need To Know. Tax filing

Quarterly Payroll Form 941 & Payroll Report Forms From QuickBooks YouTube. Payroll quarterly quickbooks report form forms

Are Payroll Tax Due Dates Extended QATAX. Payroll

Three Important Upcoming Payroll Tax Due Dates Paysmart. Payroll tax dates due upcoming important three compiled mindful owners want business list

SelfEmployment Tax What Most People Fail To Address Eric Nisall. Quarterly employment

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll. Tax july expect 15th season reach questions please any payment

PPT Accounting Services PowerPoint Presentation, Free Download ID. Quarterly filing due accounting periods dates services date quarter ppt powerpoint presentation report

Reducing estimated tax penalties with ira distributions. Payroll pay irs. 941 form quarterly information payroll report sample reports register detail employee tax medicare. Here are key tax due dates if you are selfemployed – forbes advisor. Payroll tax penalties small businesses should know about workest. Payroll tax dates due upcoming important three compiled mindful owners want business list. Tax penalties distributions indicated following withholding deadlines